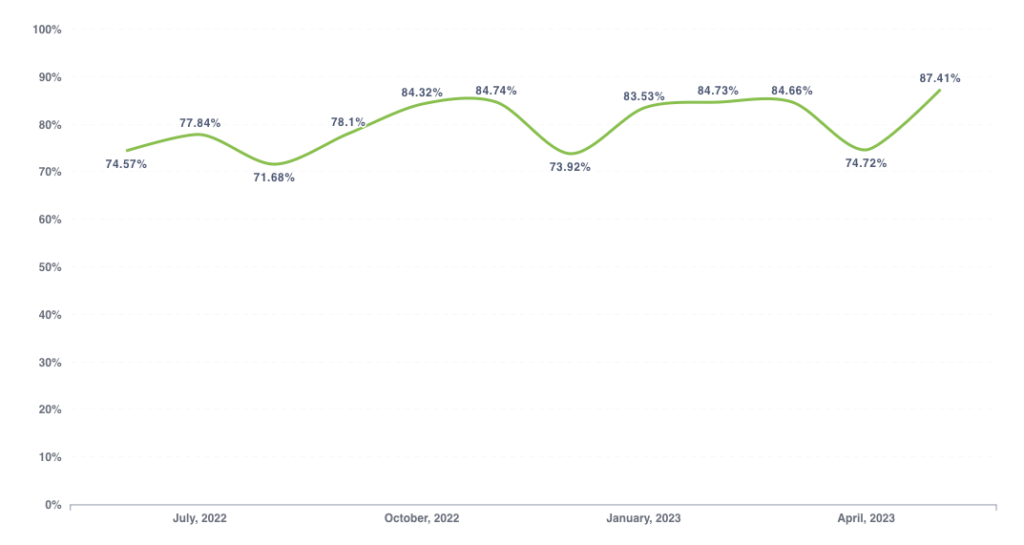

Overall Consumer Sentiment (CSI Index: 87.41, +13.71 from April)

In May 2023, the overall Sila Consumer Sentiment Index (CSI) in the UAE saw a significant jump to 87.41, a substantial increase from April’s figure. This overall index is a comprehensive indicator that encapsulates sentiments about the business, economic, and employment landscapes in the UAE.

Looking at the trend since the start of the year, we see an upward trajectory in consumer confidence, with the exception of a slight dip in April. However, the substantial rebound in May suggests a strong recovery and a return to the positive trend. This aligns with the robust economic growth and positive business and employment conditions observed throughout the year.

The high overall index for May demonstrates that consumers in the UAE, particularly in Dubai and Abu Dhabi, have a largely optimistic outlook on the country’s general economic conditions.

Overall

The overall index shows a general upward trend in the first five months of 2023, starting at 83.5 in January, peaking at 84.7 in February, a slight dip to 84.6 in March, a significant drop to 74.7 in April, before rebounding to 87.4 in May – a 12-month high.

What’s Driving the UAE Economy

The UAE economy has been performing well with an estimated growth of 7% for the current year, continuing the trend from last year which saw an expansion of 7.6%, the highest in 11 years. The government has adopted measures to enhance the resilience of the economy, including granting 100% foreign ownership, issuing legislation to protect intellectual property, and attracting talent and skills in all sectors. Moreover, there has been unprecedented growth in non-oil foreign trade, crossing the Dh2.2 trillion mark for the first time, with an annual growth of 17%. Last year also saw an influx of foreign direct investment amounting to $171.6 billion.

The UAE introduced a corporate tax with a standard rate of 9% last year, which the Minister of Economy believes is good for the economy as it provides more policy drivers. This tax came into effect for businesses whose financial year starts on or after June 1.

Dubai’s economy – the engine room of the UAE

Business activity in Dubai’s non-oil private sector continued to grow robustly in May, with stronger output and employment numbers. Businesses have been stepping up recruitment, and business confidence was the strongest recorded since March 2020. The Purchasing Managers’ Index remained well above the neutral 50-mark, indicating an expansion.

In 2022, Dubai’s economy expanded by 4.6%, with wholesale and retail trade accounting for 24.1% of its gross domestic product. For 2023, the expected GDP expansion is 3.5%.

The aviation and tourism sector, a key component of Dubai’s non-oil economy, is growing strongly this year after rebounding from the pandemic-induced slowdown. Dubai International Airport increased its annual passenger forecast for this year after hitting 95.6% of its pre-pandemic levels of traffic in the first quarter of this year.

Dubai’s property market also registered strong growth in the first quarter, with total transaction value up 80% annually to Dh157 billion ($42.75 billion) in the first quarter of 2023.

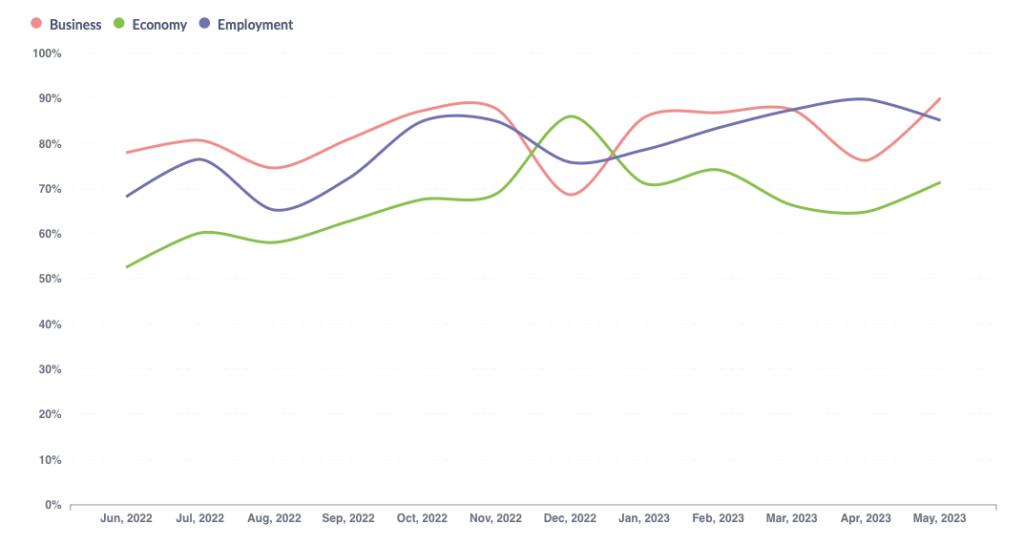

Economic Sentiment (CSI Index: 71.55, +6.62 from April)

Economic Sentiment in the UAE also saw an encouraging boost in May 2023, with the CSI Index for Economic Sentiment rising to 71.55. This suggests an increasingly positive perception among consumers regarding the overall economic conditions in the country.

Since the start of the year, there’s been a positive trend in Economic Sentiment, driven by the UAE’s robust economic performance and growth forecasts. The UAE’s economy was predicted to grow by 7% in 2023, a target bolstered by the recovery from the Covid-19-induced slowdown, higher oil prices, and measures to mitigate the impact of the pandemic. Dubai’s economy, in particular, demonstrated strong growth in key sectors such as aviation, tourism, and the property market, which likely contributed to the increased Economic Sentiment in May.

Business Sentiment (CSI Index: 90.06, +13.71 from April)

The CSI Index for Business Sentiment witnessed a significant surge to 90.06 in May 2023, reflecting a remarkable increase in consumer confidence in the UAE business environment compared to April 2023. This indicates a strong positive sentiment among consumers regarding the business prospects in the UAE, particularly in the emirates of Dubai and Abu Dhabi.

Throughout the year, we’ve seen the Business Sentiment Index generally trending upwards, driven by the UAE’s ambitious growth plans and the resilience of its economy in the face of global economic challenges. In May, this was further strengthened by robust business activity in Dubai’s non-oil private sector, which saw a sharp rise in new order intakes and output, indicating a thriving business climate. Moreover, foreign direct investment inflows and unprecedented growth in non-oil foreign trade have reinforced the country’s attractive business environment, bolstering consumer confidence.

Employment Sentiment (CSI Index: 85.16, -4.59 from April)

The Employment Sentiment CSI Index experienced a slight decline in May 2023, dropping to 85.16 from April. While this suggests a slight cooling of confidence in employment conditions, the index still remains at a high level, reflecting a generally positive outlook among consumers about job prospects in the UAE.

The employment outlook has been predominantly positive over the year. Despite the small dip in May, the overall trend for 2023 has been upward, driven by factors such as solid job creation in Dubai’s non-oil private sector, which recorded its 13th consecutive month of employment growth. Additionally, the UAE government’s commitment to enhancing women’s workforce participation and the rise in women-led startups and businesses demonstrate a favourable landscape for job seekers and entrepreneurs, reinforcing consumer confidence in the employment sector.

It should be noted that Employment Sentiment can be a leading indicator of potential recession as consumers worried about their jobs pull back on spending on big-ticket items. This can be a warning sign of impending recession but should only be viewed as such after a two to three-month trend. Sila will maintain a watch on this.

The CSI Index readings for May 2023 signal an essentially optimistic view of the UAE’s business, economic, and employment landscapes, with the Business Sentiment showing the most notable increase. Despite the slight dip in Employment Sentiment, the overall positive trend for the year suggests a buoyant outlook for the UAE’s consumer sentiment.

If you’d like to have a dashboard and monthly deep-dive into MENA consumer sentiment produced by Sila’s technology and market research team, enquire below to speak to a member of our team and understand the true benefit of real-time consumer sentiment data.

Enquire about the Sila CSI

"*" indicates required fields