Consumer Sentiment in Saudi Arabia and the UAE: The Ramadan Effect and What to Expect in 2025

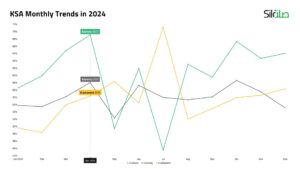

The flow of consumer sentiment in Saudi Arabia and the UAE tells a fascinating story, especially when we zoom in on the period surrounding Ramadan. This annual holy month is more than a spiritual and cultural occasion; it significantly impacts consumer confidence, spending habits, and business outlooks. By analyzing the Consumer Sentiment Index (CSI) throughout 2024, we uncover patterns that businesses and policymakers should take note of as they prepare for the coming year.

Pre-Ramadan Optimism: The Build-Up to March

As February rolled in, consumer sentiment in Saudi Arabia was already on the rise, with the CSI climbing from 62.81 to 64.58 in March. This increase was driven by a blend of anticipation and financial preparedness.

Ramadan is a time of heightened consumer activity. Households plan their budgets, stock up on essentials, and indulge in festive purchases, be it food, clothing, or gifts. Retailers and service providers respond accordingly, ramping up marketing efforts, introducing special promotions, and curating offerings that cater to the season’s unique demands. The atmosphere is full of optimism, translating into increased confidence in the economy.

A similar trend was observed in the UAE. In March, the CSI stood at 70.77 and slightly increased to 70.96 in April. This period is often characterized by increased consumer spending due to the festive nature of Ramadan, where families prepare for celebrations and gatherings, leading to a temporary boost in consumer confidence and spending.

Post-Ramadan Reality Check: The April and May Dip

But as with any peak, there comes a dip. In Saudi Arabia, the CSI dropped sharply to 59.38 in April, signaling a cautious consumer outlook. The reasons?

- Exhaustion of Disposable Income: Consumers spend significantly during Ramadan, often stretching budgets to accommodate the festive atmosphere. Post-Ramadan, many households pull back, focusing on financial recovery.

- Economic Adjustments: Spending habits shift toward essentials, and non-essential purchases take a backseat as consumers regain control over their finances.

- Market Correction: The heightened pre-Ramadan demand cools down, leading to a natural normalization in consumer sentiment.

The UAE also experienced a post-Ramadan decline, though slightly delayed. By May, the UAE’s CSI had dropped to around 67.56. Similar to Saudi Arabia, this decline can be attributed to:

- Post-Festive Spending Slowdown: After the heightened spending during Ramadan, consumers typically reduce their expenditures, leading to a natural dip in consumer sentiment.

- Economic Adjustments: The end of Ramadan often sees adjustments in household budgets as families recover from the increased spending during the festive period.

- Market Adjustments: Retailers and businesses may also adjust their strategies post-Ramadan, impacting overall market sentiment.

In Saudi Arabia, businesses felt the impact too. The Business Index plummeted from 69.54 in March to 56.72 in April, reflecting cautious business strategies and a more tempered outlook on market demand. In the UAE, while the decline was not as sharp, it still indicated a slowdown in economic activity.

Key Takeaways for Businesses

Understanding these trends presents opportunities.

- Pre-Ramadan Advantage: Brands can maximize engagement before Ramadan by offering exclusive deals, loyalty programs, and Ramadan-focused products and services.

- Post-Ramadan Retention: Rather than allowing the post-Ramadan slump to dictate business performance, companies can introduce post-Ramadan incentives—such as discounts, cashback offers, and targeted marketing campaigns—to sustain consumer engagement.

What’s Next? Will 2025 Follow the Same Path?

Given the consistent pattern of rising sentiment before Ramadan and a dip afterward, 2025 is likely to see a similar trend in both Saudi Arabia and the UAE. However, external factors such as economic policies, inflation rates, and employment stability will play crucial roles in shaping consumer confidence.

If businesses learn from past trends and adapt their strategies accordingly, they can better navigate these shifts. By proactively engaging consumers beyond the Ramadan period, offering value-driven promotions, and diversifying product offerings, they can smooth out the post-Ramadan decline and maintain steadier growth throughout the year.

Final Thoughts

Ramadan’s impact on consumer sentiment in Saudi Arabia and the UAE is undeniable. The optimism and spending enthusiasm before the holy month contrast sharply with the cautious approach that follows. Businesses that align their strategies with these consumer patterns will be better positioned to thrive—not just in the peak months, but throughout the year.

As we look ahead to 2025, one thing is clear: understanding and anticipating these shifts is key to staying ahead in an ever-evolving market. So why don’t you check out our tools that makes these insights possible? Get in touch with the team.